Table of Contents

Several methods can be used for the valuation of the property. The type of method used for the valuation generally depends upon the nature of the property as well as the availability of data.

To achieve accurate results in valuation, it is necessary to check one method by another. Some of the important methods of property valuation are described along with the solved numerical examples below.

1. Methods of Property Valuation

a. Rental Method of Valuation

The rental method of valuation is the type of valuation mostly used for fixing up taxes.

In this method, the net rental income is calculated by deducting all the expenses from the gross rent, and the obtained net rent is then multiplied by the year’s purchase to obtain the value of the property.

The general formula used is,

Capitalized value= Net rent * Year’s Purchase

Where,

Net rent = Gross rent-outgoings

Example:

The gross rent according to a property is Rs. 20,000/- p.a. Allowing 10% as deductions for repair and maintenance of the property. Determine the rental value of the property at an interest of 10%.

Solution,

Gross rent collected p.a. = Rs. 20,000/-

Expense = 10% of the gross rent collected (Since 10% of the rent is used in repair & maintenance)

= 10% of 20,000

= Rs. 2,000

Hence, the net rent collected p.a. = Rs. 20,000 – Rs. 2,000

= Rs. 18,000

Now,

Year’s Purchase = 100/10=10 (Considering year’s purchase for a long time)

Thus,

Capitalized Value = Net rent * Year’s purchase

= Rs. 18,000 * 10

= Rs. 1, 80, 000

b. Profit-Based Method of Valuation

Profit based method of valuation is similar to the rental method of valuation.

It is a widely used method for the valuation of profit-based properties such as cinema halls, shopping malls, etc.

In this method, the net profit is first calculated after deducting all the expenses which are then multiplied with the year’s purchase to obtain the capitalized value.

Example:

Determine the valuation of a cinema house if the cost of land is Rs. 1,20,000. Gross income per year is Rs. 7,50,000. Expenses required per year include:

a) Taxes and charges are 30% of gross income.

b) Repair and maintenance cost is 5% of the capital cost of Rs. 9,50,000.

c) Sinking fund as in 25 years at 4% after allowing 10% scrap value.

d) The insurance premium is Rs. 10,000 per year.

Assume a year’s purchase for 60 years at 8% and redemption capital at 4%, annual repair of the house at 2% on gross income.

Solution,

Gross income per year = Rs. 7,50,000

a) Taxes and charges = 30% of gross income

= 30% of 7,50,000

= Rs. 2,25,000

b) Repair and maintenance charge= 5% of Rs. 9,50,000

= Rs. 47,500

c) Fund after 10 % Scarp value = Rs. 9,50,000 * 9/10 = Rs. 8,55,000

Sinking fund coefficient = 0.04/ {((1+0.04) ^25) -1}= 0.24

Hence, Sinking fund = Rs. 8,55,000 * 0.024 = Rs. 20,520

d) Insurance premium per year= Rs. 10,000

e) The yearly charge for annual repair = 2% of gross income

= Rs. 15,000

Hence, total expenses = Rs. 3,18,000 (obtained by adding each expense)

Net income = Gross income – expenses

= Rs. 7,50,000 – Rs. 3,18,020

= Rs. 4,31,980

Now,

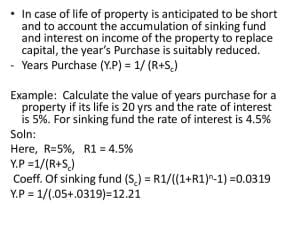

year’s purchase = 1/ (R + Sc )

Where,

R = 8% = 0.08

Coefficient of sinking fund (Sc) = 0.04/{(( 1+0.04) ^60) -1} = 0.0042

Hence,

year’s purchase = 1/(R + S c ) = 11.88

Capital value = Rs. 4,31,980 * 11.88 = Rs. 51,31,922

Value of building = Rs. 51,31,922 + Rs. 1,20,000

= Rs. 52,51,922

This was for the Methods of Property Valuation.

Note: Formulas used

Read Also: Property Valuation by Fixation of Rent